does binance send tax forms

Upload your CSV or XLSX files here. How do I know.

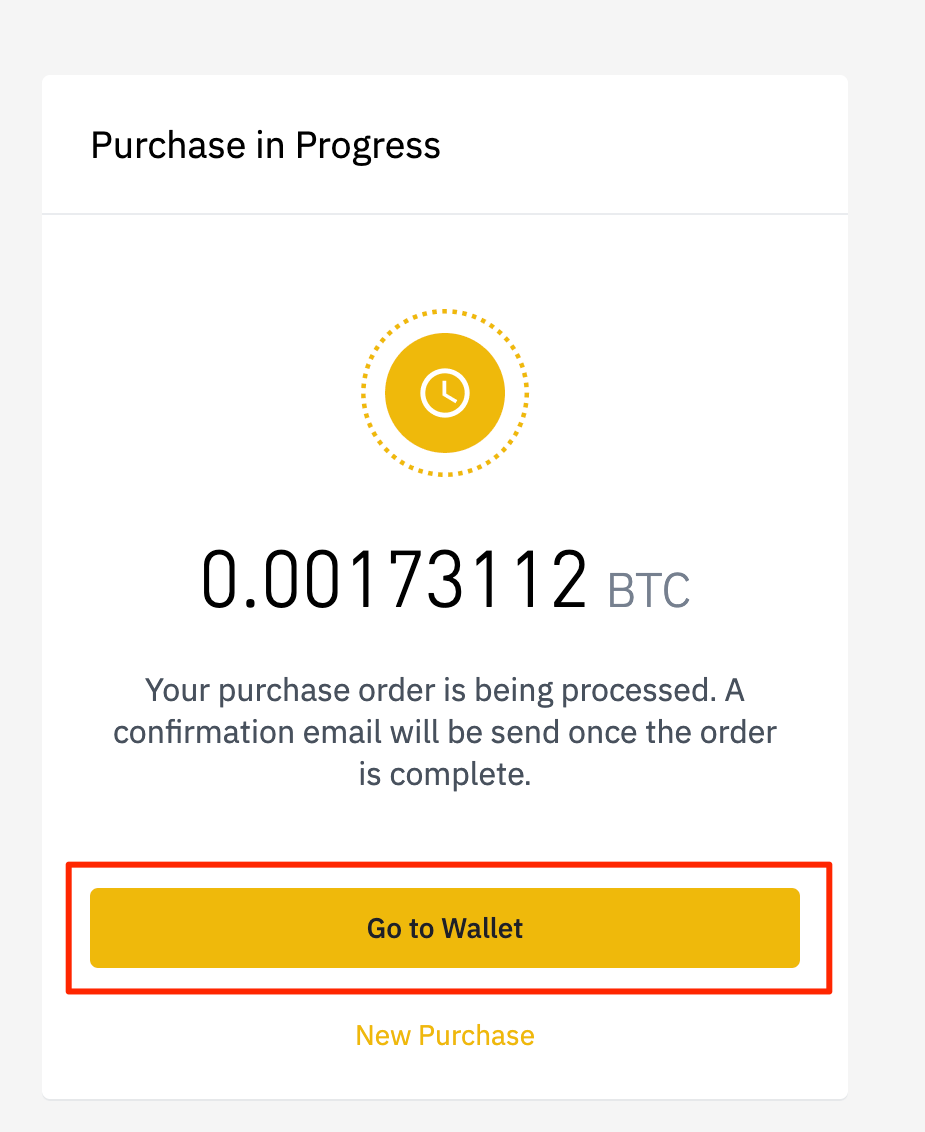

How To Buy Sell Convert Crypto Binance Us

This form provides information about miscellaneous income and does not include information about capital gains and losses from disposals which is needed to accurately report your taxes.

. Binance is not a US-based exchange and it does not report anything to the IRS. Under the Account section tap on Tax Statements. Then click Secure Import.

Then Does BinanceUS Issue 1099-MISCs and Report to the IRS. Meaning you will need to import 4 files for every year of trading. BAM Trading Services Inc.

Binance US issues a 1099-MISC form to any user with more than 600 in crypto income like through staking or airdrops. On the drop-down menu select Tax Statements. Label your wallet name click Setup auto-sync.

Choose Binance from the list of exchanges given in the exchange section. Remember whenever you get a 1099 form - the IRS gets an identical copy. Although it previously issued certain traders Forms 1099-K BinanceUS discontinued the practice.

Then click Secure Import. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct.

They can request your data from any larger crypto exchange operating in the US. BinanceUS makes answering this requirement easier by providing you with your transaction history available to download. Go to Wallets and click Add Wallet.

Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards. Youll normally receive your 1099-MISC form by February of the following tax year at the latest. We worked closely with TaxBit a crypto tax and accounting platform to ensure BinanceUS customers can generate free ready-to-file tax forms by connecting their BinanceUS account to TaxBit.

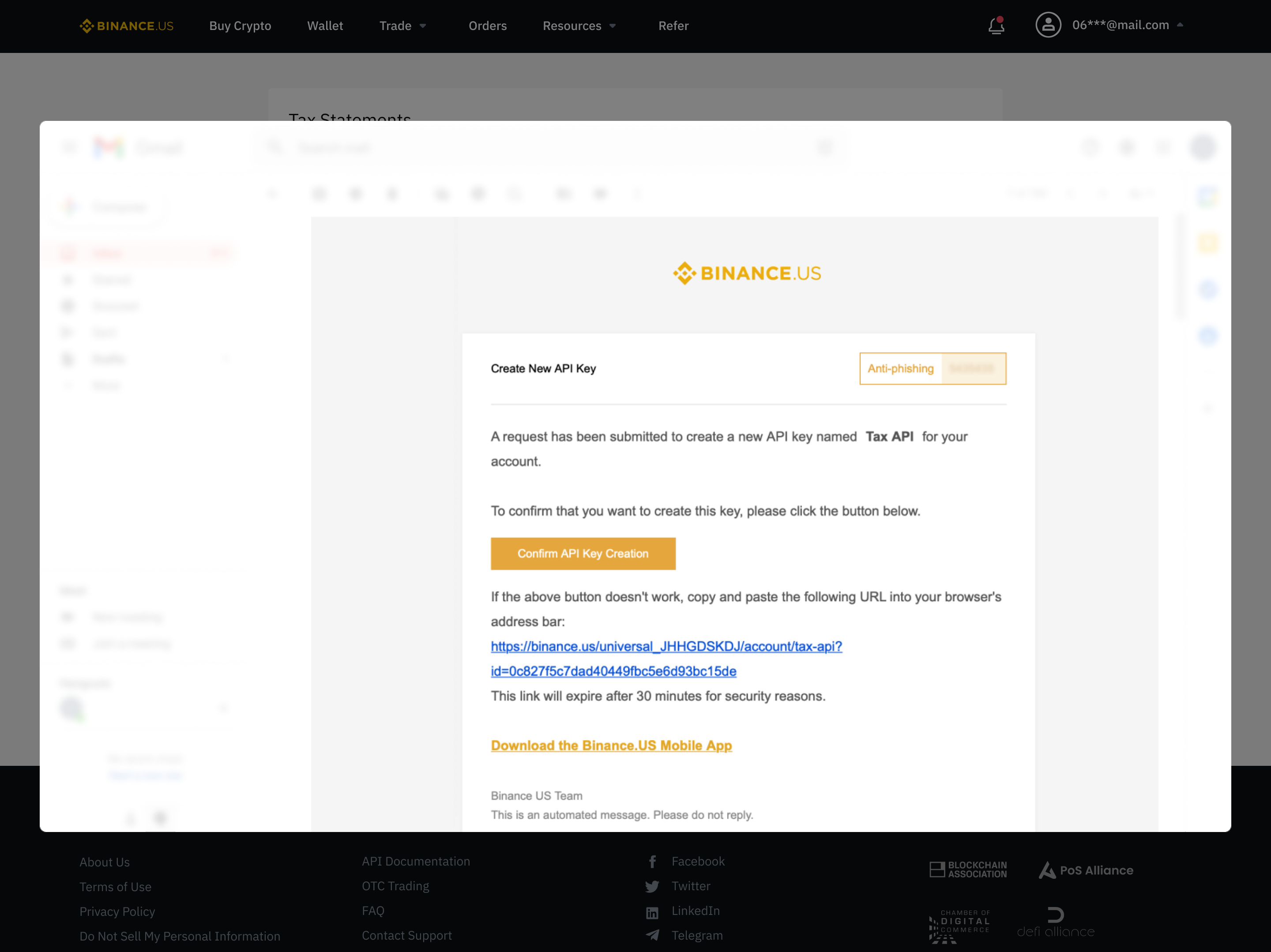

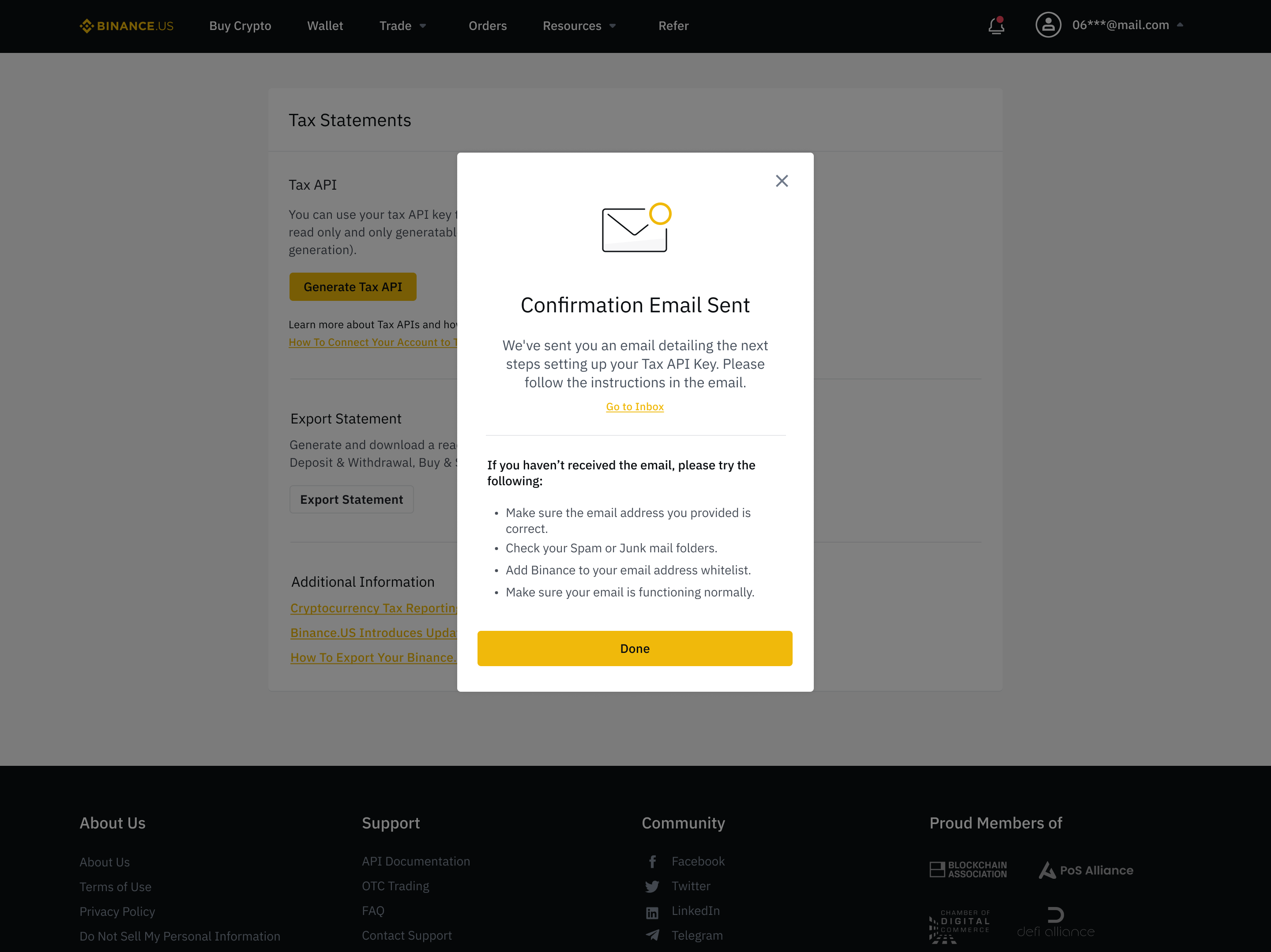

Taxpayers to answer yes or no to whether they had any crypto transactions during the year. Open the BinanceUS app and tap the User Profile icon on the bottom navigation bar. You will see a Setup Binance API pop up.

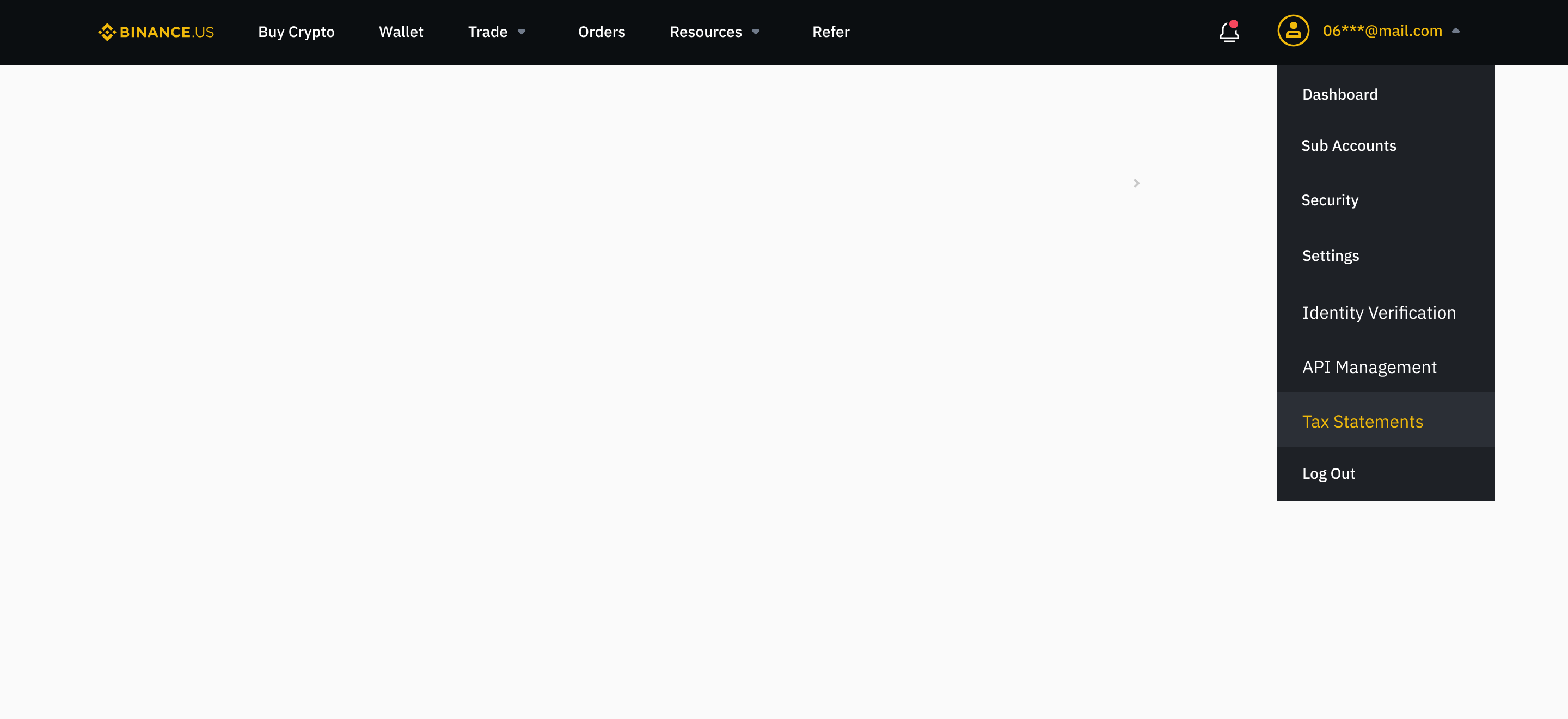

Log in to your account and hover your cursor over your User Profile on the top right side of your screen. In 2019 the IRS introduced a mandatory check box on Form 1040 US. If you earned at least 600 through staking or Learn and Earn rewards BinanceUS issues 1099-MISCs and reports to the IRS.

When a customer earns more than 600 through staking referrals and other income-generating activities BinanceUS issues a Form 1099-MISC and files an identical copy with the IRS. Does Binance US issue 1099 forms. Simply follow the steps given below Login to your ZenLedger account.

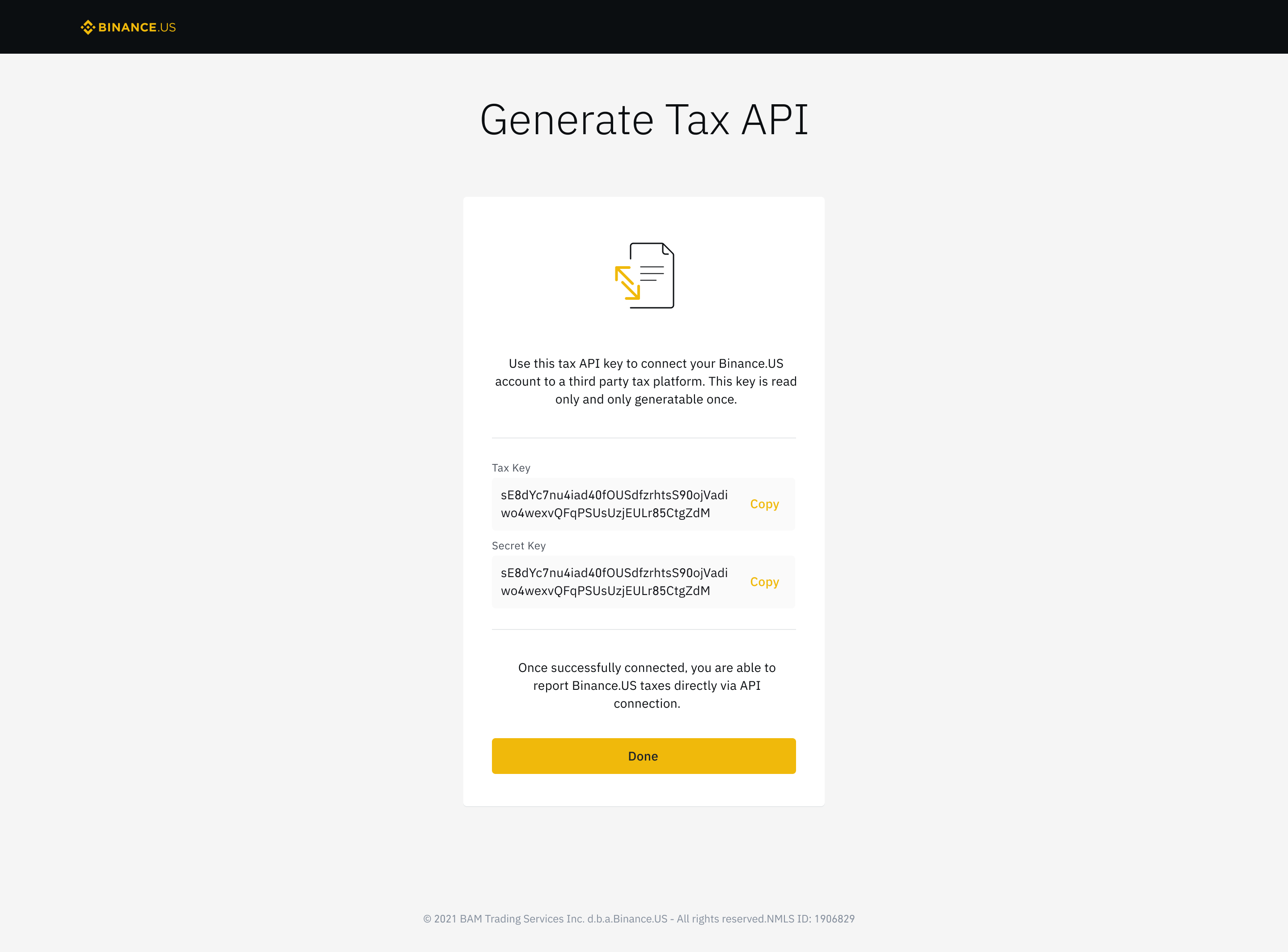

Label your wallet name click Setup auto-sync. Enter the unique API keys and Secret Key you received from the Binance Tax Report API. These kinds of incomes are classified as ordinary income.

BinanceUS will use Sovos technology to automate its 1099 forms and filings which helps reduce potential human errors and ensure automatic regulatory updates. Binance does not issue a 1099 form to its customers because it is not a US-based exchange and it no longer serves US. You will see a Setup Binance API pop up.

By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards compliance and could avoid. Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada.

Enter the unique API key and Secret Key you received from the Binance Tax Report API. Binance us tax forms. We recommend contacting a tax professional for your specific tax.

The companys Tax Information Reporting solution which has experience in handling tax issue in alternative currency markets allows BinanceUS to protect its users just as investors of other. On iOS or Android. Click on the Import option and choose Add Account.

On the right hand side youll see import instructions if any. Go to Wallets and click Add Wallet. Individual Income Tax Return requiring US.

Click on Export Complete Trade History at the top right corner. Does Binance report to tax authorities. The new Tax API Key tool offers wide compatibility with most third party tax reporting platforms.

The best way to remain tax compliant with the IRS is to report your crypto taxes accurately. As the tax filing season approaches we hope the Export Statement tool can help you organize your transaction records. Binance allows exporting trades for a 3 month period at a time.

Yes Binance does provide tax info but you need to understand what this entails. Binance Tax Reporting You can generate your gains losses and income tax reports from your Binance investing activity by connecting your account with CoinLedger. BinanceUS does not provide tax advice.

While Binance US might not be sending out 1099-K forms the IRS is taking a hard stance on crypto tax evasion. Were always looking for new ways to improve your crypto experience. Suppose you have the Binance Tax Report API of your Binance tax documents.

BinanceUS is part of the TaxBit Network.

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Generate Your Tax Api Key Binance Us Tax Reporting Binance Us

How To Find Your Transaction History On Binance For Taxes Followchain

How To Find Your Transaction History On Binance For Taxes Followchain

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Generate Your Tax Api Key Binance Us Tax Reporting Binance Us

How To Buy Sell Convert Crypto Binance Us

How To Complete Entity Verification For Corporate Accounts Binance Support

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Generate Your Tax Api Key Binance Us Tax Reporting Binance Us

How To Find Your Transaction History On Binance For Taxes Followchain

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Find Your Transaction History On Binance For Taxes Followchain

How To Generate Your Tax Api Key Binance Us Tax Reporting Binance Us

How To Generate Your Tax Api Key Binance Us Tax Reporting Binance Us

How To Complete Entity Verification For Corporate Accounts Binance Support